60+ how many points does a mortgage inquiry affect credit score

If youre considering applying for a loan or mortgage heres what you need to. Ad Check How Much Home Loan You Can Afford.

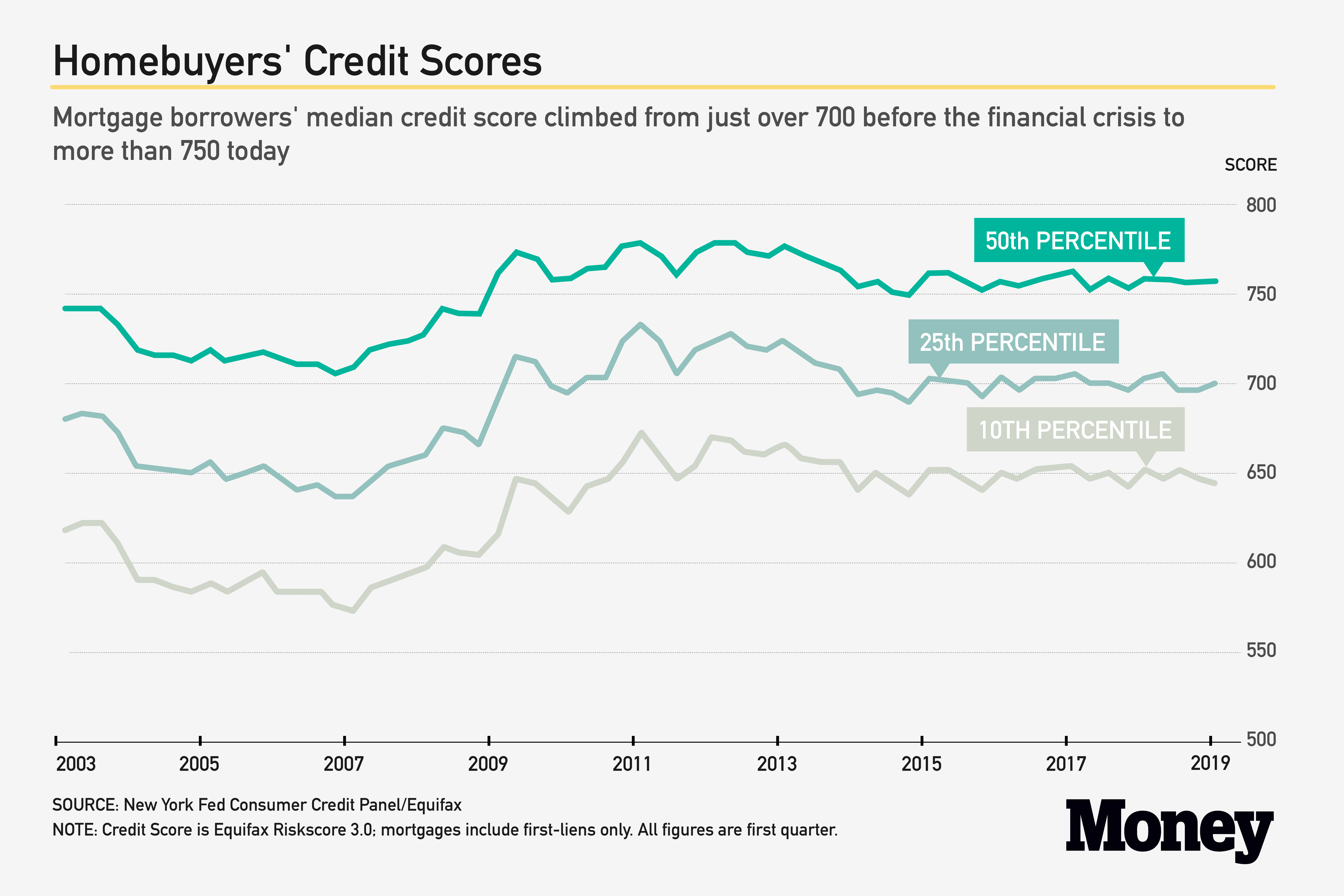

This Is The Credit Score You Need For A Mortgage Money

Comparisons Trusted by 55000000.

. Ad 10 Best Home Loan Lenders Compared Reviewed. For most people one additional credit inquiry will take less than five points off their FICO Scores. Compare Loans Calculate Payments - All Online.

Get Instantly Matched With Your Ideal Mortgage Lender. Web There are two types of credit score inquiries lenders and others like yourself or your landlord can make on your credit score. Web Typically when someone does a hard inquiry on your credit your credit score will drop by five to 10 points.

Web Typically your credit score will dip by 2 to 10 points after a hard credit inquiry. Web In general credit inquiries have a small impact on your FICO Scores. Lock Your Rate Today.

Get Instantly Matched With Your Ideal Mortgage Lender. A hard inquiry and a soft inquiry The. Web Hard inquiries can impact your credit score but by how much.

Although the information stays on your report for up to two years the negative. Web That means you can apply for mortgage loans with 100 different lenders over a 30-day period and all 100 of those inquiries will be ignored. Web Dear JOE According to FICO a hard inquiry from a lender will decrease your credit score five points or less.

Web In the long run having a mortgage and paying it off as agreed can help you build a stronger credit profile. Ad 10 Best Home Loan Lenders Compared Reviewed. A study by LendingTree found that US.

Web Credit score calculated based on FICO Score 8 model. Your lender or insurer may use a different FICO Score than FICO Score 8 or another type of credit score. This number can be even lower than five points.

Access to all 3 Credit Scores now is more important than ever. Quick FAQs on how mortgage applications affect. If you have a strong credit history and no other credit issues you.

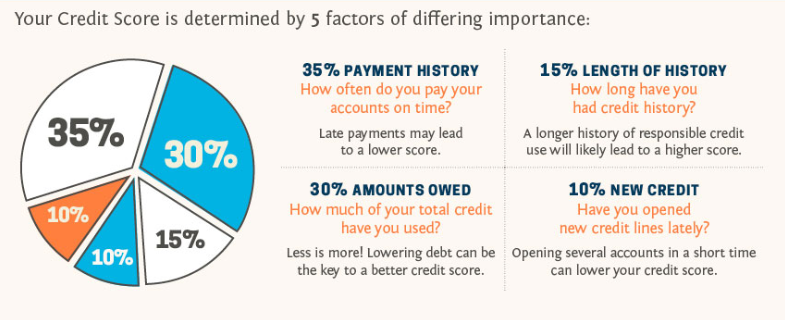

However the impact is minimal. Web Assuming nothing in a mortgage application changes except the credit score someone with a score in the 680-699 range would have a mortgage rate. Web Multiple hard inquiries actually rank at the bottom of the list of actions that negatively impact your credit score.

Lock Your Rate Today. That means theyll have. Web When you apply for a mortgage your credit score will drop slightly.

An inquiry typically has a small but negative impact on your credit score. Web A hard credit inquiry which happens when you apply for a loan or credit card usually causes a borrowers credit score to drop by 5-10 points. Ad We fill in the gaps that other credit score providers simply dont.

Comparisons Trusted by 55000000. Web A mortgage adds to your credit history Nothing affects credit score more than your payment history. Mortgages typically require 15 to 30 years of payments which is plenty.

Web Inquiries tell other creditors that you are thinking of taking on new debt.

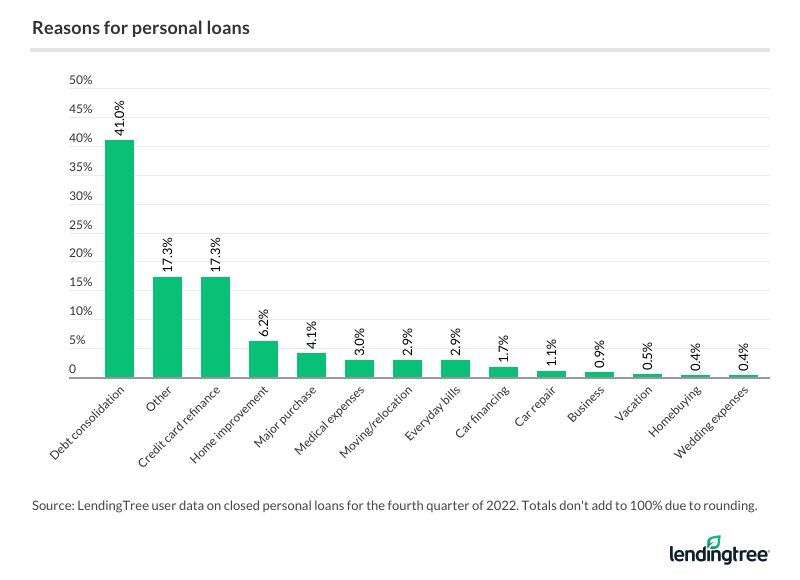

Personal Loan Statistics 2023 Lendingtree

7 Steps To A Great Credit Score Wealth Mode Financial Planning

Do Multiple Loan Inquiries Affect Your Credit Score Experian

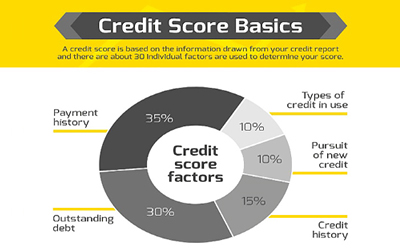

Credit Report And Credit Score Basics

Does A Personal Loan Hurt Your Credit Score Mymoneysouq Financial Blog

All Signs Point To A Healthy Credit Market In 2022 Transunion

Run The Numbers

How Many Points Does A Mortgage Inquiry Affect Your Credit Score Go Clean Credit

How Many Points Does An Inquiry Drop Your Credit Score Experian

What Credit Score Should You Have In 2022

Your Fico Score Vantage Mortgage Brokers

What S A Good Credit Score To Have How To Get It Valuepenguin

Average Credit Score By Age In The U S Rocket Hq

Do All Mortgage Lenders Credit Score Mortgage Plus Lenders That Don T

Economic Impacts Of The Covid 19 Crisis Evidence From Credit And Debt Of Older Adults Journal Of Pension Economics Finance Cambridge Core

What Credit Score Do You Need To Get A Mortgage Learn The Key Fico Thresholds

How Long Do Hard Inquiries Stay On Your Credit Report Experian